- Walk-in Traffic is by Appointment Only - More Details

Everything You Need To Know About Landlord Insurance

Property Value Calculation for Your Real Estate Investment

January 12, 2024

What Neighborhoods in Charlotte Are Growing?

February 2, 2024Key Benefits of Landlord Insurance

Landlord insurance is an indispensable safeguard for property owners who venture into renting out their properties. This specialized form of insurance deviates significantly from standard homeowners insurance by catering to leasing property’s unique challenges and risks.

Its primary purpose is to shield property owners from unforeseen financial burdens due to damages to the rental property, legal liabilities, or loss of rental income. Understanding landlord insurance is the first step toward ensuring your investment remains secure and profitable.

Why Landlord Insurance is Crucial

Renting out property, while potentially lucrative, carries with it a spectrum of risks that can threaten the financial stability of landlords. Landlord insurance acts as a critical buffer against such vulnerabilities.

It affords protection in several key areas: it covers the cost of repairs or reconstruction following incidents like fires or natural disasters; it provides financial compensation for lost rental income during periods when the property is uninhabitable; and it offers liability coverage if residents or visitors suffer injuries on the premises due to the landlord’s negligence.

The absence of landlord insurance could leave property owners facing hefty out-of-pocket expenses for repairs and legal defenses, potentially undermining the viability of their investment.

What Does Landlord Insurance Cover?

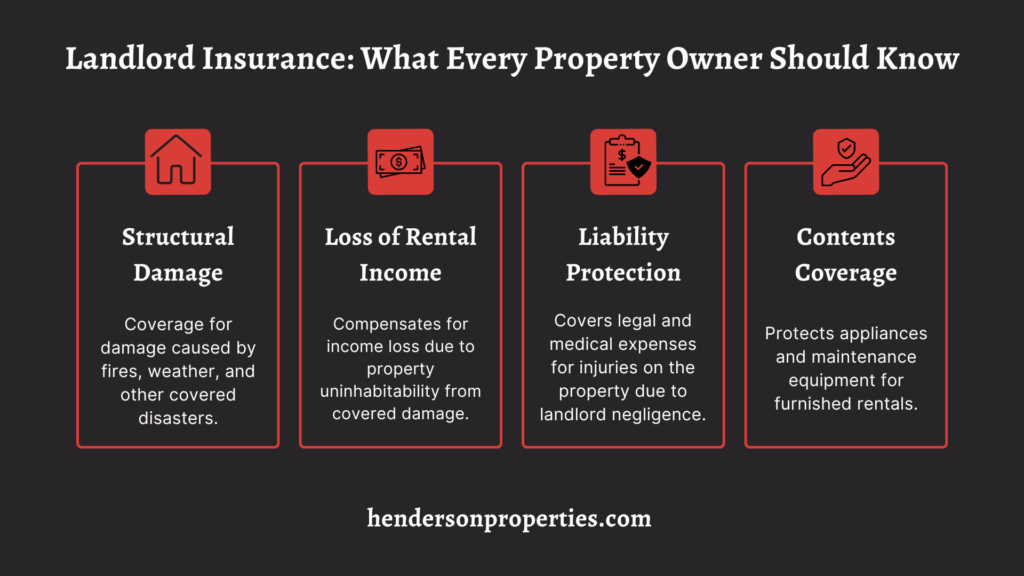

Landlord insurance is vital for rental property owners, offering broad protection across various potential incidents and challenges. This type of policy is meticulously crafted to mitigate the financial risks landlords face, from physical damage to the property to liability issues. Here are the key coverages that landlord insurance typically provides:

- Structural Damage: Protection against damage from fires, weather, and other covered disasters.

- Loss of Rental Income: Compensation if a property becomes uninhabitable due to covered damage, protecting landlords from loss of income.

- Liability Protection: Coverage for legal and medical expenses if someone is injured on the property due to the landlord’s negligence.

- Contents Coverage: For landlords who provide furnished rentals, this includes coverage for appliances and maintenance equipment against damage or theft.

Additional Coverages to Consider

Landlords are encouraged to explore additional coverages that can be appended to their primary policy, including protection against vandalism and burglary, which safeguards the landlord’s financial interest if the property is subject to theft or malicious damage.

Since standard landlord policies typically exclude natural disasters such as floods and earthquakes, acquiring separate policies for these specific risks is advisable for properties in prone areas.

Another critical area of supplemental coverage is legal expense coverage, which assists in defraying the costs associated with legal disputes, resident evictions, or lease violations.

Policy Exclusions

Common exclusions from coverage include maintenance-related issues, such as appliances’ natural wear and tear and intentional damage caused by residents. These exclusions underscore the importance of landlords being proactive in their property maintenance and management practices to mitigate risks outside the insurance coverage’s purview.

Landlord Insurance for Different Types of Rental Properties

Choosing the right landlord insurance requires understanding how the type of rental property and the duration of rental agreements affect coverage needs. Different properties and rental arrangements come with unique risks and considerations:

- Single-Family Homes:

- Coverage is typically more straightforward, focusing on the structure and the land.

- Risks are generally more predictable, emphasizing protecting the property from standard perils like fire or storms.

- Multi-Unit Properties:

- Increased complexity in insurance needs due to multiple residents and shared spaces.

- Coverage must include common areas such as hallways, roofs, and amenities, protecting against damage and liability claims.

- Rental Duration Considerations:

- Short-Term Rentals:

- Often listed on platforms like Airbnb, these properties see high turnover and varied use.

- Insurance may align more with commercial policies, prioritizing liability coverage due to increased risk of damage and legal claims.

- Long-Term Leases:

- Characterized by lower resident turnover, potentially reducing some risks.

- Comprehensive coverage is still essential for protecting against structural damage, liability, and loss of rental income.

- Short-Term Rentals:

How to Choose the Right Policy

The property’s geographical location plays a pivotal role, as areas prone to natural disasters or high crime rates may require additional coverage specifics, such as flood or earthquake insurance. The rental property’s characteristics, including whether it’s a single-family home or a multi-unit dwelling, and the nature of the rental agreement—short-term vs. long-term—also significantly impact the kind of insurance policy best suited to your needs.

It’s important to assess the cost of premiums, the breadth of coverage offered, the insurer’s reputation for customer service, and their efficiency in handling claims. Gathering quotes from multiple insurance providers and reading through customer reviews and testimonials can provide valuable insights into each insurer’s reliability and the suitability of their policies for your specific requirements.

The Cost of Landlord Insurance

The premiums for landlord insurance are determined by a blend of factors, including the property’s location, the building’s replacement cost, the type of rental operation being run, and the level of coverage selected.

Landlords looking to minimize their insurance costs might consider strategies such as opting for a higher deductible, which can lower premium payments, bundling multiple policies with the same insurer for a discount, or making safety upgrades to the property to reduce the likelihood of claims.

Making a Claim

Understanding the claims process is crucial for landlords. Here’s what you should be aware of:

- Notify your insurance provider immediately after an incident.

- Document the event and resulting damages comprehensively.

- Cooperate with the insurer’s requests for information or property access.

- Keep up-to-date property condition records.

- Maintain an inventory of included appliances and furniture.

- Understand your policy’s coverage details.

- Educate residents on reporting maintenance issues or damages.

Need Help?

By investing the time to secure the right coverage, landlords can protect their investment, provide a safe and appealing living environment for their residents, and navigate the challenges of property rental with confidence and peace of mind.

Contact Henderson Properties today if you need help managing your rental property.