- Walk-in Traffic is by Appointment Only - More Details

Strategically Transferring Your Rental Property to an LLC

Why Real Estate Agents Have Excellent Work-Life Balance

November 6, 2023

Buying a Home in Charlotte? Here’s What Happens Next

December 5, 2023A Step-by-Step Guide

Real estate investment requires a keen understanding of how to protect your assets. At Henderson Properties, we recognize the critical nature of these decisions, particularly when they involve transferring rental property into a Limited Liability Company (LLC).

This guide is designed to provide you with a comprehensive understanding of this process, drawing on our extensive real estate and property management expertise.

Benefits of an LLC for Rental Properties

An LLC effectively creates a legal barrier between your assets and your rental property, offering protection in case of legal issues or financial obligations related to the property. This separation is essential in today’s litigious society, where personal assets can be vulnerable.

Moreover, LLCs can offer attractive tax benefits. They allow for pass-through taxation, meaning the company’s profits are taxed only once, potentially leading to significant tax savings.

An often overlooked advantage of an LLC is the privacy it offers. By holding property in an LLC, your personal information remains private, providing a layer of anonymity that can be beneficial in various business scenarios.

The Process of Forming Your LLC

The process of forming your LLC starts with a key decision: determining the type that aligns with your investment goals, whether it’s a single-member or a multi-member LLC. Understanding the distinct legal and tax implications of each type is crucial. Following this decision, the formation of your LLC involves several important steps:

- Select LLC Type:

- Single-member or multi-member.

- Consider specific legal and tax implications.

- File Articles of Organization:

- Officially register your LLC with the state.

- Appoint a Registered Agent:

- Choose an agent responsible for handling legal and tax documents.

- Ensures legal standing and compliance of your LLC.

Legal and Financial Complexities

Transferring your property into an LLC can activate the due-on-sale clause of your mortgage, requiring the balance to be paid in full. This scenario necessitates careful communication with your lender to avoid unintended financial consequences.

Updating your insurance policies is another critical step, as personal insurance policies may no longer provide coverage once the property is under an LLC.

Additionally, each state has specific legal requirements for LLCs, and it’s essential to ensure your LLC complies with these to maintain its legitimacy and protection.

Effective LLC Management

After setting up your LLC, managing it effectively is crucial to maintaining its protective benefits. This includes establishing separate financial accounts for the LLC to ensure a clear distinction between personal and business finances.

An operating agreement is also a fundamental component of your LLC. This document lays out your LLC’s management structure, financial arrangements, and operational procedures, and should be crafted with precision and foresight. Regular adherence to legal requirements such as annual filings and fee payments is necessary to keep your LLC in good standing.

The Property Transfer Process

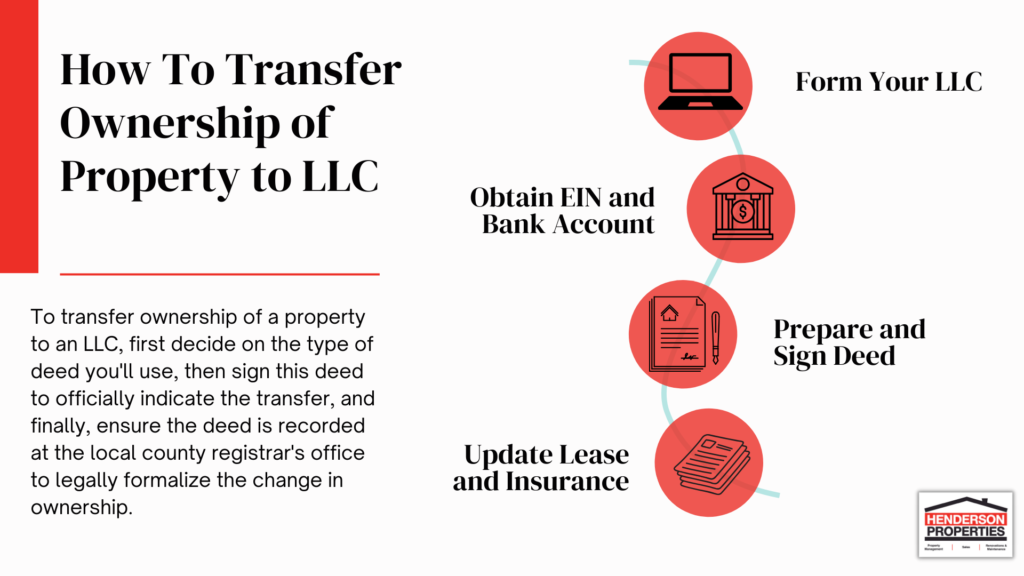

In the property transfer process to your LLC, the crucial step is choosing the right deed – either a quitclaim or a warranty deed, each having specific legal implications. After selecting the appropriate deed, it must be signed and officially recorded at the county level to formalize the transfer.

- Choose the Right Deed: Select a quitclaim deed (transfers interest without title guarantees) or a warranty deed (offers assurances against liens or encumbrances).

- Formalize the Transfer: Sign and record the chosen deed at the county level to complete the property transfer process.

Avoiding Nuances

One of the major pitfalls in this process is inadvertently triggering the ‘due-on-sale’ clause in your mortgage, which can lead to financial strain. Negotiations with your lender are critical to avoid this scenario.

Additionally, how you form and operate your LLC can have significant implications. For example, commingling personal and business funds can undermine the legal separation provided by the LLC, potentially exposing your assets.

Need Help?

Making the decision to transfer your rental property to an LLC involves weighing various factors, including legal, financial, and operational considerations. At Henderson Properties, our expertise and experience are at your disposal, guiding you through these complexities to ensure a secure and compliant investment.

Let us be your partner in optimizing and securing your real estate investments. Contact us today for assistance.