- Walk-in Traffic is by Appointment Only - More Details

Property Value Calculation for Your Real Estate Investment

Charlotte’s 2024 Real Estate Investment Gems

January 6, 2024

Everything You Need To Know About Landlord Insurance

February 1, 2024Value Calculation for Savvy Investors

Understanding the value of your investment is not just beneficial; it’s essential.

Whether you plan to buy, sell, or assess your portfolio, an accurate valuation lays the foundation for informed decision-making.

This article will navigate you through the various approaches and nuances of property valuation, tailoring insights specifically for a vigorous real estate market like Charlotte.

Understanding Rental Income as a Valuation Factor

Rental income is a key determinant in evaluating a property’s worth. It’s crucial to distinguish between Adjusted Gross Rental Income, which accounts for vacancy losses and other income adjustments, and Gross Rental Income, the total potential income without deductions.

These figures provide a snapshot of a property’s earning potential and are fundamental to several valuation techniques.

Key aspects to consider include:

- Adjusted Gross Rental Income:

- Accounts for vacancy losses and other adjustments.

- Offers a realistic view of the property’s actual earning potential.

- Gross Rental Income:

- Represents the total potential income without any deductions.

- Provides an initial estimate of the maximum earning capacity.

The Income/Cap Rate Approach

The Income/Cap Rate Approach is integral in real estate valuation, particularly significant for properties that generate regular income. This method starts with calculating the Net Operating Income (NOI), which is the revenue remaining after all operating expenses are deducted from the adjusted gross rental income. These expenses include day-to-day costs such as maintenance, property management fees, insurance, and taxes.

The adjusted gross rental income is calculated by considering potential income and adjusting for factors like vacancies and credit losses, offering a realistic view of the property’s financial performance.

Central to this approach is the Capitalization Rate (Cap Rate), a crucial metric indicating the investor’s expected return on investment. The Cap Rate is derived by dividing the NOI by the current market value or the property’s purchase price.

It verifies the investment’s risk and return profile; a higher Cap Rate generally implies higher risk and potential return, making it a vital figure in evaluating and comparing investment opportunities.

By efficiently utilizing this approach, investors can compare properties within the same market segment and make informed decisions based on the potential returns relative to the investment’s risk. This method not only assists in understanding a property’s current value but provides insights into its future income potential and overall investment appeal.

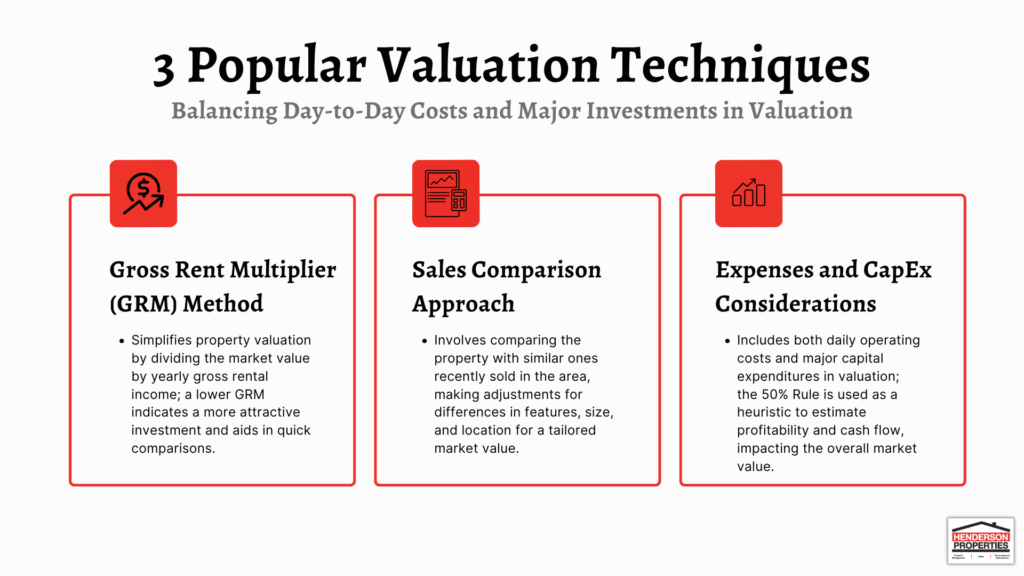

The Gross Rent Multiplier (GRM) Method

The Gross Rent Multiplier (GRM) Method is a straightforward technique for evaluating property value and is useful for rapid assessments. It simplifies the valuation process by comparing a property’s market value to its gross rental income:

- Calculating GRM: Determine the GRM by dividing the property’s market value by its yearly gross rental income.

- Assessing Investment Value: A lower GRM suggests a more attractive investment, allowing for effective comparison of properties in similar areas.

- Efficient Property Screening: GRM is particularly beneficial for quickly evaluating and comparing potential investments in fast-paced markets.

The Sales Comparison Approach

The Sales Comparison Approach is pivotal for understanding how your property stacks up against the market. It involves a detailed comparison with similar properties – “comparables” – recently sold in the same area.

Adjustments are made based on differences in features, size, condition, and location, providing a tailored market value estimate for your property.

Factoring in Operating Expenses and CapEx

When evaluating a property’s value, consider both operating expenses and capital expenditures (CapEx). Operating expenses encompass the day-to-day costs of maintaining and managing the property, such as repairs, maintenance, and property management fees.

On the other hand, CapEx refers to larger expenditures that significantly enhance or improve the property, like major renovations or structural repairs. These expenses directly impact the property’s net operating income and, by extension, its overall valuation.

To simplify this aspect of property valuation, investors often use the 50% Rule. This rule of thumb suggests that operating expenses will approximate half of the property’s gross rental income. This exploratory provides a quick and easy way to estimate a property’s profitability and cash flow, which are key factors in determining its market value.

While not a substitute for detailed financial analysis, the 50% Rule offers a useful starting point for assessing a property’s financial health.

Market Trends and Economic Factors

Market Trends and Economic Factors

Understanding the value of a property goes beyond its physical attributes and location; broader market trends and economic factors equally influence it:

- Understanding Market Influences: Factors like local job market trends, ongoing development projects, and shifts in neighborhood dynamics have a significant impact on property values. These aspects are indicators of the area’s economic vitality and potential for growth, and they play a crucial role in how a property is valued.

- Expert Market Analysis: At Henderson Properties Realtors, we leverage our deep understanding of market trends to provide accurate and predictive property valuations. Our analysis considers current economic conditions and potential future changes, ensuring that our valuations are comprehensive and reflective of real market scenarios.

Professional Appraisals vs. Automated Valuation Models

While some online tools offer quick and user-friendly valuations, professional appraisals provide a depth of analysis unmatched by automated models.

Knowing when to rely on each method and how they complement each other is key to a comprehensive valuation strategy.

Integrating Various Valuation Methods

At Henderson Properties Realtors, we champion an integrated approach to property valuation.

By combining different methodologies, investors gain a multifaceted perspective of their property’s value, enabling strategic decision-making. As your trusted partner in the real estate journey, we’re committed to providing you with the insights and support needed to navigate the complex world of property investment confidently.

Ready to invest? Reach out to one of our investor-friendly real estate agents to get started!