- Walk-in Traffic is by Appointment Only - More Details

The Profitability Puzzle: Vacation vs Long-term Rental Properties

Boost Your Investments: The Power of an Experienced Real Estate Agent

May 26, 2023

Mastering Home Maintenance: A Guide to Hiring a Handyman

July 11, 2023Long-term vs. Vacation Rentals

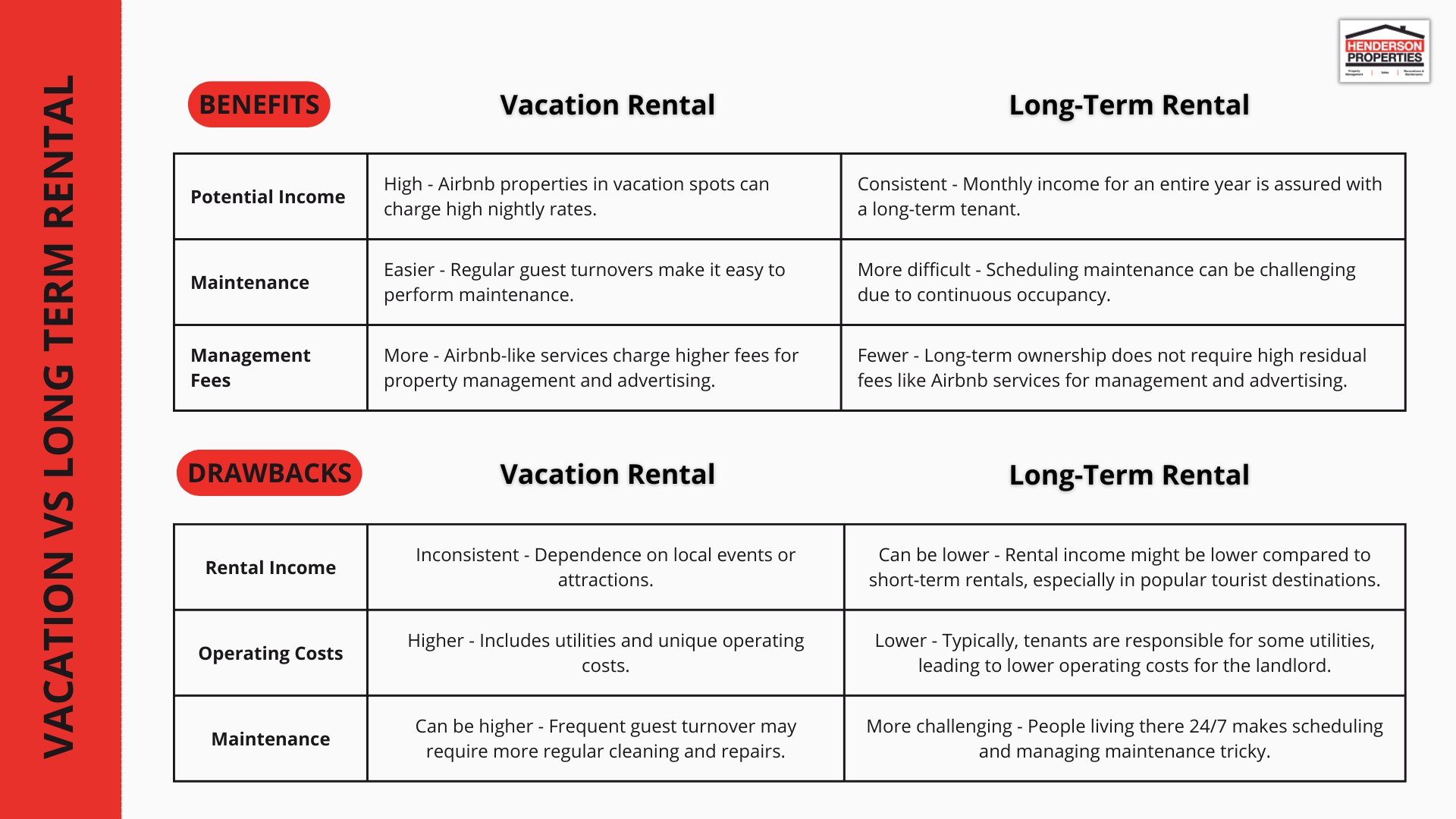

When you invest in a residential property, that’s your valuable time and money. Like most people, you want a good return on investment (ROI). In real estate investment, two potential money-making options are vacation and long-term rentals.

Our experience in the real estate environment shows that long-term rentals offer better results. Below, you’ll find out about the benefits and downsides of long-term and vacation rentals.

Benefits and Downsides of Short-term Vacation Rentals

Short-term rentals are offered to people temporarily, for a few days or a week. If you’ve ever used an Airbnb, you’re familiar with short-term rental properties.

Short-term rentals have unique advantages and disadvantages for real estate investors. Let’s break those down below:

Benefits

- High potential income. If you live in a vacation spot, Airbnb-type properties can charge high nightly rates. Some are willing to pay the “home away from home feeling” premium.

- Easier to perform maintenance. Because guests are in and out, getting in to fix a problem is much easier.

Downsides

- Inconsistent rental income. Short-term rentals often struggle with irregular income. They are contingent upon nearby events or attractions.

- Difficult to finance. Because income is inconsistent, it’s challenging for buyers to get a house.

- Higher operating costs. Buyers are responsible for utilities and unique operating expenses. Those costs are much higher than long-term alternatives.

Benefits and Downsides of Long-term Rentals

Long-term rental properties include your standard six-month to one-year leases. One resident lives there for the long term, where they can use the home per your rental contract.

Because long-term properties are more consistent, they have advantages and disadvantages.

Benefits

- Consistent income. A long-term resident provides you with monthly income for an entire year.

- Easier to get financing. Because you get consistent money, banks are more comfortable selling this as an investment property.

- Fewer property management fees. Airbnb-like services charge huge residuals to help manage and advertise your property. You don’t pay those as a long-term owner.

Downsides

- Scheduling maintenance can be difficult. Because people live there 24/7, scheduling and managing maintenance can get tricky.

Maintenance and Cleaning: Differences Between Vacation Rental and Long-Term

Speaking of maintenance, long-term and vacation rentals are completely different.

Vacation rentals are generally easier to maintain because there will be days people aren’t there. These rentals also cost more to maintain because you must constantly check them. Like a hotel, short-term rentals can feel like a full-time job.

Maintenance is more difficult in long-term properties. Most lease agreements dictate when you can and can’t enter the premises. At most, you can inspect the property once a year.

The good news is that you can establish a security deposit to handle these problems in long-term rentals. So, you won’t be out of luck if someone trashes your place.

Property management companies that handle short-term properties might also have these. However, they are generally much smaller, which might not help if someone has trashed your property.

Rental Rates: Understanding How Vacation Rentals and Long-Term Rentals

Investment properties (vacation and long-term) have expected profit margins of around 10%. The only thing that changes is when you get paid.

A long-term lease gives you monthly rent throughout the year. This offers comfort and consistency, which is ideal if you don’t want to take a risk. Lulls in rental income are less common in long-term properties.

Vacation properties have a peak season that depends on where you live. These peak seasons revolve around holidays and events. So, if you are a short-term rental owner, you might get all your income in December.

In both cases, it’s a good idea to base your rental rates on what similar properties in your area are going for. If you know you offer a premium experience, don’t be afraid to bump up the price.

Guest Screening: How Vacation Rentals and Long-Term Rentals Differ

With long-term and vacation properties, you can find a property management company offering background checks. But, guest screening between the two services can differ heavily.

Long-term rentals typically have more control. Property management companies can learn a lot about people during the check process. You might also be able to meet with the new resident. Getting to know a person can help establish a rapport, which helps with maintenance and annual checks later.

Short-term properties might make it difficult to meet with everyone. Still, you should be able to check with them to be sure they haven’t brought 15 people and all their dogs.

A full background check is one thing you can’t do with short-term rentals. This isn’t cost-effective and often takes too much time, especially if the guest books your room for the next day.

Wrap Up – Vacation Rental vs. Long-Term Rental, Which is Better?

Both vacation and long-term rentals have pros and cons. But here’s the breakdown:

You should pick a vacation rental if your area is a tourist hot spot. It’s a higher-risk investment but can result in great earnings.

Our vote is for the stable option: long-term rentals. They typically have the same profit margin with far less risk. Plus, you get monthly income, not sporadic income.

To get assistance in each rental investment process step, contact the Henderson Properties team today.